Guide Overview

Concerns about the cost of finishing their degree often stop people from even getting started or exploring their options.

In this guide, we'll help alleviate those concerns and provide expert advice into:

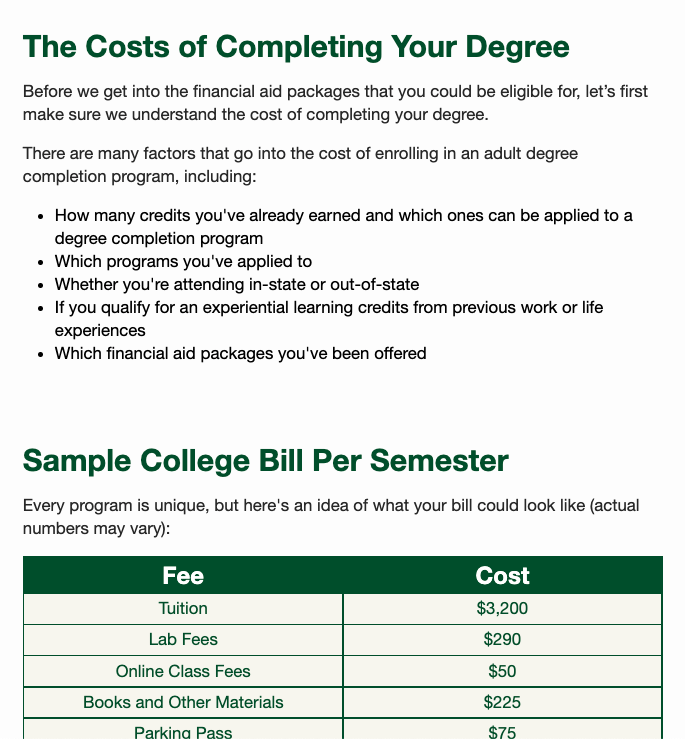

There are many factors that go into the cost of finishing your degree, including prior credits earned, which program you enroll in, and which financial aid packages you've been offered.

Take a look at a sample college bill which includes typical costs for items like tuition, lab fees, books, and other expenses.

We look at a simple formula you can use to understand what your costs might be based on the number of credits you need to earn.

We explore the scholarships and grants that are available to working adults in Tennessee who want to go back to school, including Tennessee-specific options and those available at the federal level.

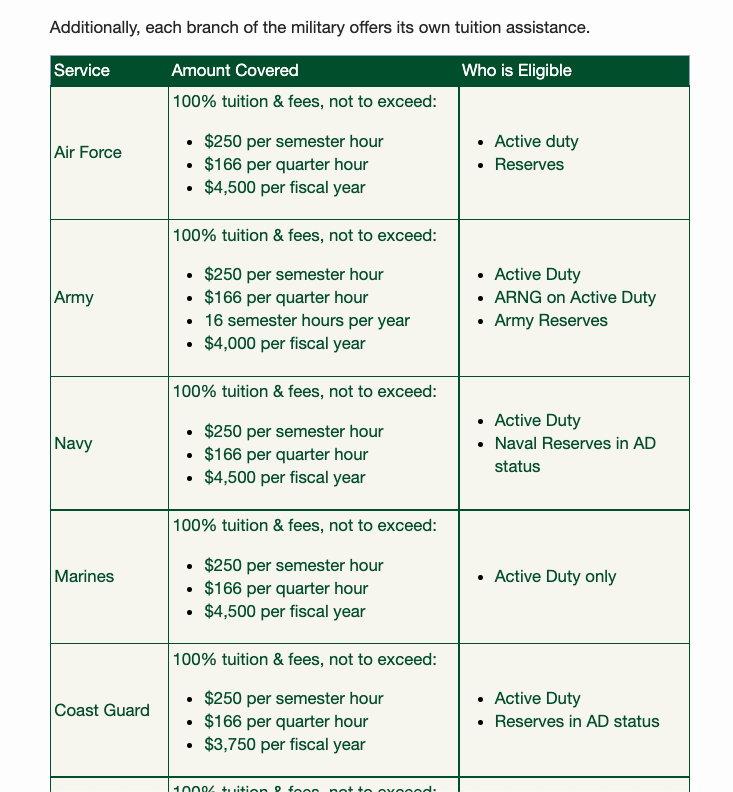

If you’re a veteran or active service member, there are several military grants and scholarships created specifically for you and your family.

Student loans can be a great option to help pay for school. You'll have to pay them back, but we explore the affordability and flexibility of student loans in this guide.

What You'll Learn

1. Factors that Impact the Degree Cost

There are many factors that go into the cost of finishing your degree, including prior credits earned, which program you enroll in, and which financial aid packages you've been offered.

2. What a Sample College Bill Looks Like

Take a look at a sample college bill which includes typical costs for items like tuition, lab fees, books, and other expenses.

3. How to Calculate Your Estimated Cost

We look at a simple formula you can use to understand what your costs might be based on the number of credits you need to earn.

4. Grants and Scholarships in Tennessee

We explore the scholarships and grants that are available to working adults in Tennessee who want to go back to school, including Tennessee-specific options and those available at the federal level.

5. Scholarships for Military Members

If you’re a veteran or active service member, there are several military grants and scholarships created specifically for you and your family.

6. The Benefits of Student Loans

Student loans can be a great option to help pay for school. You'll have to pay them back, but we explore the affordability and flexibility of student loans in this guide.

Request More Info

Interested in learning more about completing your bachelor's degree at Southern? You can schedule a personal meeting right here or fill out the form below for more program information.